ANALYSIS: By Soheil Mohseni, Te Herenga Waka — Victoria University of Wellington and Alan Brent, Te Herenga Waka — Victoria University of Wellington

Globally, the electricity sector is shifting from large, centralised grids powered by fossil fuels to smaller and smarter renewable local networks.

One area of strong interest is “energy arbitrage”, which allows users to buy and store electricity when it is cheaper and sell or use it when the cost is high.

But Aotearoa New Zealand is slow to take this up — even though it is a crucial part of the transition to a zero-carbon future. Why is this?

- READ MORE: Good news – there’s a clean energy gold rush under way. We’ll need it to tackle energy price turbulence and coal’s exodus

- ‘We want to be part of that movement’: residents embrace renewable energy but worry how their towns will change

- Other renewable energy reports

Small-grid technologies and infrastructure are still in the experimental phase, being tested for effectiveness and desirability of different set-ups, ownership models and commercial arrangements.

And intelligent energy-management systems that can provide a prescient forecast of market dynamics are not used widely.

To better understand these dynamics, we have modelled a theoretical “microgrid” in a residential subdivision, Totarabank, in the North Island of Aotearoa.

We used the model to forecast the expected commercial returns from investing in microgrids and to unlock potential revenue streams from energy arbitrage.

Smart scheduling of batteries

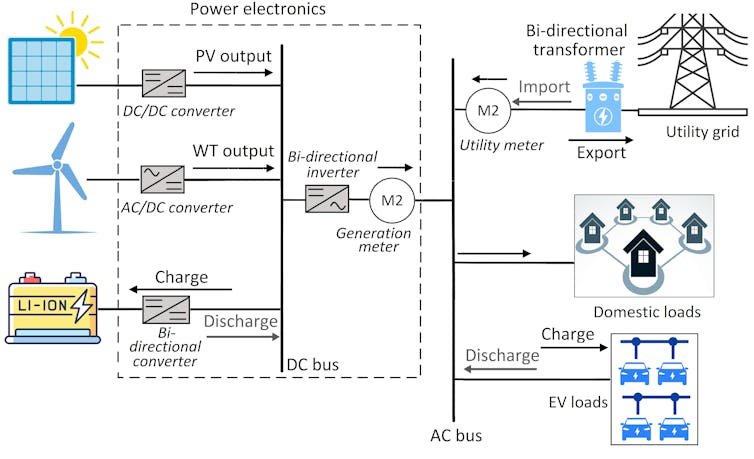

Energy arbitrage requires battery storage and intelligent control to make the most of a local renewable energy system’s generation.

This can be achieved by forecasting short-term future electricity consumption and linking this to the spot power price on the market. Sophisticated real-time controllers then decide if the local system should store or sell to the market (or store and sell later).

Battery storage systems can vary in size, from community-scale batteries supplying a neighbourhood to batteries within a fleet of electric vehicles (EVs). The fundamental controlling processes required to achieve an optimal outcome are broadly the same, except that community batteries are stationary while EV batteries move around.

Community batteries can store electricity purchased from the grid during off-peak periods and then discharge it during peak periods. Neighbourhoods with solar power can charge community batteries in the middle of the day when solar-generated electricity is abundant and discharge during the higher-priced evening peak.

EV batteries can be used similarly, using cheaper night rates or periods of surplus wind during the night to charge. The energy stored in EV batteries can then be discharged into local loads or sold back into the grid when the price is highest, creating an additional revenue stream.

Modelling return on investment

In our modelling, we assumed the primary reasons people will invest in clean-energy technologies are sustainability, energy independence and resilience. We believe energy arbitrage could be an enabler of capital-intensive microgrids, as opposed to an investment made on a purely commercial basis.

Specifically, we considered a grid-connected microgrid integrating solar photovoltaic (PV) and wind turbines. The system is also backed by a community battery and has a fleet of 10 personal EVs to serve.

We considered two scenarios: one with grid arbitrage revenues and one without.

Our results suggest revenues procured explicitly from energy arbitrage could reduce the total cost of the system by at least 12 percent. To put this into perspective, for a typical NZ$10 million town-wide microgrid investment, this means $1.2 million in savings.

Another interesting finding was that the length of time the batteries were able to sustain critical loads during unplanned grid outages was greater by about 16 hours per year, compared to the case without intelligent control. This is a remarkable resilience advantage.

So what does this kind of analysis mean for you? If you are part of a community interested in owning and operating a microgrid, you now have enough evidence to ask your developer to consider energy arbitrage so the community can participate in the electricity market to make a profit.

If you own an EV and are trying to get cheaper night rates, this is a heads-up on future offerings from electricity retailers to get your storage-on-wheels to work with the vehicle-to-grid technology.

On the whole, energy arbitrage is an excellent tool to provide support for renewable energy investment decisions and help firm up revenue forecasts.![]()

Dr Soheil Mohseni, postdoctoral research fellow in sustainable energy systems, Te Herenga Waka — Victoria University of Wellington and Dr Alan Brent, professor and chair in sustainable energy systems, Te Herenga Waka — Victoria University of Wellington. This article is republished from The Conversation under a Creative Commons licence. Read the original article.