By Johnny Blades of RNZ Pacific

Political fallout from a controversial loan taken on by Papua New Guinea’s government five years ago could hinder rather than help attempts to remove Prime Minister Peter O’Neill.

O’Neill and other leading officials have been referred by the Ombudsman Commission to a Leadership Tribunal over a US$1.2 billion loan his government took on from Swiss-based investment bank UBS in 2014.

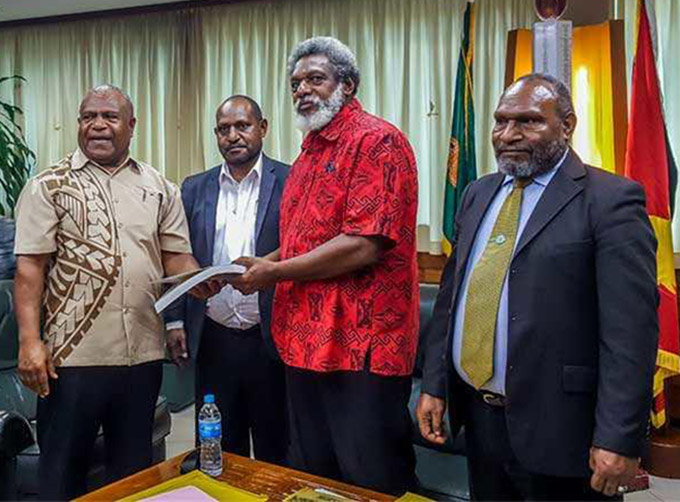

The ombudman’s report, which was completed last December but only handed to the Parliament Speaker, Job Pomat, late last month, is yet to be tabled in the house.

READ MORE: UBS loan to PNG may have breached 15 laws

LISTEN: The controversial loan saga on RNZ Dateline Pacific

However, the report has been published at a time when the parliamentary opposition, bolstered by recent defections from the government, is planning for a vote of no confidence against the prime minister later this month.

The UBS loan was nominally taken for the state to buy a 10 percent stake in oil and gas producer Oil Search, a major player in PNG’s burgeoning petroleum sector.

In last week’s heated Parliament debate the prime minister said it was imperative for the state to regain Oil Search shares.

These were earlier lost after being mortgaged by PNG’s Sir Michael Somare government in 2009 as it sought finance from the United Arab Emirates-based International Petroleum Investment Company to gain equity in the country’s first LNG gas project.

‘Strategic investment’

“The Treasury officials said the Oil Search investment is a strategic investment to government,” O’Neill explained in Parliament last week.

“So the company decided to offer the government of Papua New Guinea at a special issue so we can secure the 10 percent. Why? Because Oil Search, even today, is the biggest company in PNG, is the biggest taxpayer in PNG.

However, the report reveals that the Ombudsman found the prime minister failed to present the government’s proposal on the borrowing of a loan, from UBS’ Australia branch, in Parliament for debate and approval as required by the constitution.

O’Neill was found to have misled the cabinet into approving the loan, among other irregularities. But he was not alone.

The commission’s findings also implicate the former Finance Minister, James Marape, who was found to have signed off the loan’s approval as minister despite knowledge of irregularities and “that his actions were improper”.

According to the opposition’s justice spokesman, Kerenga Kua, the deal and O’Neill’s lead role in pushing it through were very suspicious. He said the greatest transgression in the deal was its commercial injustice.

“In the end we only held that share for about twelve months before it was foreclosed by UBS and sold. So you see we don’t have those shares in our hands any more, because the state fell into default on that loan arrangement.”

Stock price fell

PNG was forced to sell its Oil Search shares when the stock price fell sharply, incurring a big loss. On the other hand, UBS profited around US$83 million in fees, interest and trading revenue from the deal.

Kua said the financial professionals involved in arranging the huge loan must have known the transaction was bound to fail for PNG.

“They would have seen this as a scam, a real professional scam. Because everybody knew of the state’s financial vulnerability, and its lack of cash flow to pay for that loan,” Kua said.

“Yet they created a monster, so that within a matter of months it would fall into default, and then you foreclose on the asset, cover yourself. But what are the people of PNG left with? Nothing, except a debt of 3 billion kina [NZ$1.4 billion].”

But an issue over which the opposition has been attacking O’Neill for years is now proving problematic for the MP seeking to replace the prime minister.

Marape, who resigned last month as minister and left the ruling party, has emerged as the opposition’s choice for alternative prime minister in a motion of confidence against O’Neill which it lodged last week.

But along with other officials, including Government Chief Secretary Isaac Lupari, Treasury Secretary Dairi Vele, and the Central Bank Governor Loi Bakani, Marape has also been referred by the Ombudsman Commission for investigation under the leadership code over the UBS loan. This undermines his own recent attacks on the prime minister.

Questions unsuccessful

Standing on opposite sides of the Parliament chamber for the first time last week, Marape questioned the prime minister about the loan process. The questions were unsuccessful because the prime minister was able to remind Marape that he was also involved in those decisions himself.

While it remains to be seen whether O’Neill, Marape and others will face the Leadership Tribunal, the opposition continues to portray the prime minister as the lead transgressor in the UBS saga and other controversies.

The former Health Minister, Sir Puka Temu, who also left the government last month, has portrayed the prime minister as exerting too much control on state departments, overriding the authority of ministers.

“I resigned because I saw things were not working well. There were a lot of corrupt practices and there were governance processes from agencies and bodies of the state that the leaders did not support,” Sir Puka said.

O’Neill has denied any wrongdoing, characterising the investigation as politically motivated, and part of a “dirty game” by the opposition as it tries to lure support to change the government.

He has indicated that the issue would be the subject of a judicial review.

Although he was a member of the last Somare government in its later stages, O’Neill has placed blame with that regime for placing PNG in a weak position when it sought finance in Abu Dhabi for the LNG Project.

Country ‘mortgaged’

“When they borrowed that money, when the mortgaged not only Oil Search, but they borrowed every state-owned entity of this country,” O’Neill explained.

“So if we wanted to sell one of the planes in Air Niugini, we had to ask the permission of the Arabs. If we wanted to sell one of the buildings in any of the SOEs, we had to ask the Arabs. So literally, we were mortgaged to the Arabs.”

But Kua said the O’Neill government’s purchase of Oil Search shares under the controversial UBS loan was a far more shoddy deal than the IPIC transaction.

“The IPIC transaction led to PNG owning 19.26 percent in the PNG LNG Project. That equity is still there and annually we are receiving over a billion kina in revenue from that project,” he explained.

The UBS loan was opposed from an early stage by the then Treasurer Don Polye, who ultimately refused to sign off on the deal before resigning in protest.

Polye insisted that the loan required parliamentary approval, warning that taking the loan on would break the country’s official debt ceiling.

The former Kandep MP was also not involved in the negotiations with Oil Search on the purchase of the shares.

‘Cup of coffee’

According to the Ombudsman report, the agreement to buy the shares was reached “over a cup of coffee” in a swanky Port Moresby hotel when O’Neill and Vele met with Oil Search’s managing director Peter Botten and its board chair, Gerea Aopi.

The government’s purchase of the Oil Search shares allowed the company to buy a stake in the Elk Antelope gas field in PNG’s Gulf province. This resource is being developed by French company Total SA to be the second major LNG project in PNG.

The Papua LNG Project agreement was signed by Total and the government last month.

However, the agreement immediately preceded the exodus from O’Neill’s ruling party, and was cited as a causal factor in the move by several of the MPs who resigned, including Marape.

Warning that interests of provinces and landowners were not being protected, the MPs lamented that promised equity and royalty benefits from PNG’s first big LNG gas project, based in Marape’s province, had still not transpired, 10 years after that project agreement.

Meanwhile, the Chief Ombudsman, Richard Pagen, says the commission submitted its final UBS report to the Parliament Speaker, Job Pomat, on April 30.

Asserting that the commission has jurisdiction over the prime minister’s office, Pagen said the Speaker must table the report within 8 sitting days of receiving it.

Public interest

However, he added that the commission decided to publish the report as it considered it a matter of public interest

Only one day of Parliament sitting has lapsed since the handover of the report. That was last Tuesday, May 7, the same day the opposition lodged its motion of no confidence, when Pomat adjourned parliament until May 28.

PNG’s Attorney-General has filed a Supreme Court application to which could yet delay the confidence vote against the prime minister proceeding.

Opposition MPs say they’re confident that the vote will go ahead. The group is not likely to change Marape’s nomination as alternative prime minister, but his involvement in the UBS loan may yet count against him.

- This article is published under the Pacific Media Centre’s content partnership with Radio New Zealand.

- O’Neill on ABC’s Pacific Beat programme

- Marape accuses O’Neill government of ‘sabotage ploy’