China is currently building more coal plants than it needs and in doing so is misallocating capital at an unprecedented rate.

As of July 2016, China had 895 GW of existing coal capacity being used less than half of the time – and perversely has 205 GW under construction and another 405 GW of capacity planned, with a total overnight capital cost of half a trillion US dollars.

This misallocation of capital is a microcosm of wider structural woes within the Chinese economy. China’s rapid economic growth, demographic profile and geographical size has meant it often made sense for the government to build power infrastructure first and ask questions later.

The days when China could grow at a fast pace by accumulating capital, safe in the knowledge that this capital would achieve high returns, appear to be over.

China’s coal power investments have reached an important juncture: keep pouring capital into increasingly unviable projects and put the financial system under additional pressure from the risk of large-scale defaults, or stop investing and promote efficiency.

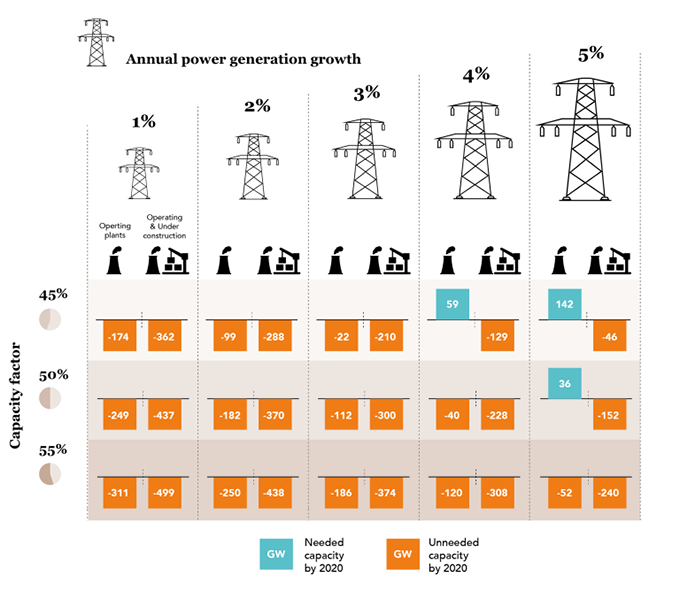

As power demand growth slows from a historical average of 10 percent to 3 percent or less per year, the coal capacity in the pipeline, as well as some existing coal capacity, risks becoming stranded due to low carbon capacity targets, ongoing reforms in the power sector and carbon pricing.

A new report, Chasing the Dragon? China’s coal capacity crisis and what it means for investors, presents analysis which finds China no longer needs to build any additional coal plants and therefore it makes sense to act with conviction to contain its coal overcapacity crisis.

To prove this, Carbon Tracker Initiative developed a short-term scenario analysing the 2020 targets in the 13th five-year plan (13 FYP) and a long-term scenario analysing the implications of limiting the average global temperature increase to 2°C.

Carbon Tracker Initiative also develop a 2020 reform scenario which models the potential impact of power market reforms and a national emission trading scheme (ETS) on the gross profitability of each operating coal plant in China.

Investors who fail to understand the immediacy of China’s energy transition could find themselves chasing fossil fuel demand that is not there.

13th five-year plan doesn’t add up for coal generation

Low carbon capacity targets in the 13 FYP coupled with a low power demand environment will likely strand coal capacity. Additional capacity beyond existing plants is only required by 2020 if power generation growth exceeds 4% per year and coal plants are run at a capacity factor of 45% or less. If plants under construction are built and existing capacity are run at a 45% capacity factor, then 210 GW of coal capacity is unneeded in 2020 in an environment where power generation growth is 3% per year. Indeed, even in the most optimistic scenario (i.e. sub 45% capacity factor and above 5% power generation growth) there would still be a surplus if capacity under construction is built and operated alongside existing capacity.

Half a trillion US dollars of wasted capital could be avoided

To remain consistent with the IEA’s 2°C scenario (2DS) China can avoid building any new coal plants from now until 2032 by marginally increasing the utilization of their existing fleet. After 2032, the existing fleet becomes inconsistent with the 2DS due to rapidly declining capacity factors and therefore units will need to be progressively retrofitted with Carbon Capture and Storage (CCS) or retired prematurely.

Since China can rely on its existing units to generate the power allocated to unabated coal plants in the 2DS, all units currently under construction and planned are not needed and pose a significant financial risk. Based on a capital cost of US$800 million per kW, US$490 billion of capital could be wasted on plants under construction and planned.

2°C carbon budget bust in 2030s without further policy reform

If no new coal plants are built and each existing unit is retired when it turns 40 years old, the 2°C carbon budget will still be exhausted by 2040. After 2040, coal capacity would need to emit no carbon to remain consistent with the 2°C budget. This is currently technically impossible as existing CCS-equipped coal plants still emit around 100 grams of carbon per kWh. If under construction capacity is built alongside existing capacity with a 40-year lifetime, the 2°C budget will be exhausted by 2036.

Given it would not be practical to phase-out a large amount of generation in a single year, the transition away from coal will obviously require retirements before this date. It is important to note that this scenario analysis uses a capacity factor of 50% and is based on a 50% chance of limiting the average global temperature increase to 2°C.

he following factors will both reduce the 2°C budget and consume it more quickly: (i) holding temperate rise to well below 2°C as described in the Paris Agreement; (ii) a higher probability of limiting temperature rise; and (iii) a higher capacity factor.

Reforms on the rise

Whether through an economic, air quality or climate lens, the Chinese government has every reason to contain its coal overcapacity crisis. The National Development and Reform Commission (NDRC) and other government institutions are aware of the overcapacity crisis and the need for policy interventions to return coal generation investments to equilibrium.

The reforms from the government have increased in frequency and severity in 2016. A policy proposal was released in April to halt the construction of 372 GW of planned capacity – greater than the entire US coal fleet. Even plants under construction are not safe: more recently, the NDRC made the decision to halt 17 GW already under construction, setting a legal precedent that will likely be repeated in the future.

Power market reforms, in combination with the national ETS, could strand coal units with higher operating costs by promoting least cost units and low carbon generation.

Carbon Tracker Initiative developed a 2020 reform scenario to illustrate the impact of a national ETS and power market reforms.

Incorporating a carbon price of $US10/tCO2 to reflect the introduction of a national ETS in 2017 and a 15 percent reduction in coal power tariffs from ongoing power market reforms, the gross profitability of the operating fleet halves by 2020, with 27 GW becoming cash flow negative and 140 GW making a gross profit of US$5 per MWh or less.

The NDRC put – China to become a net exporter of coal again

The Chinese government are like the central bank of the seaborne coal market. The stellar gains in thermal coal prices this year are entirely a result of China’s NDRC. It’s becoming harder to see how these gains can be sustained.

The NDRC has intervened to supress prices by relaxing its production cuts. By restarting mothballed capacity seaborne investors are actively challenging the effectiveness of Chinese policy.

If history is any guide, betting against the efficaciousness of Chinese policy is not sensible. With China acting as the marginal buyer on the seaborne coal market, investors should prepare themselves for a world where China is a net exporter.

Given the expected coal generation levels by 2020 under the 13 FYP, Carbon Tracker Initiative expects thermal coal demand to be lower than 2015 levels. Even if Chinese domestic supply is curtailed somewhat during this period, it could still result in China no longer being a net importer.

The technology race

The bilateral agreements between China and the US administrations to make efforts to reduce emissions to prevent dangerous levels of climate change sent several signals. One key section related to how both of the world’s largest economies would be investing in the technologies to deliver a low carbon future.

Clearly there are huge opportunities to export the solutions for the companies that win the race.

Questions have been raised as to whether the US will still be in the race under its incoming President – hopefully the economic opportunities and energy independence offered by new energy technologies will make them attractive to the new administration.

Regardless, we believe China will keep racing forward either way for all the reasons outlined above.

Conclusion

The basic maths of continued growth in China’s coal capacity does not add up, and the 13 FYP marks the point where this cannot be ignored any longer. The changing generation mix, the slowdown in power generation growth and existing coal plant overcapacity combine to present a different challenge for China.

With coal generation set to peak, there is no need for further coal capacity, whilst on the supply side, there is the potential for China to become a net exporter of coal again.