By Dionisia Tabureguci of Business Melanesia

As Fiji picks up the pieces after Tropical Cyclone Winston’s ravaging impact in late February, tourism and remittances are standing by as white knights for an economy that is expected to downgrade growth figures from an expected 3.5 percent of GDP this year.

Preliminary damage assessment released by the nation’s disaster management center, DISMAC, when this edition of Business Melanesia went to press stood at F$476.3 million, an equivalent of almost 5 percent of the country’s nominal GDP of F$9.69bn as stated in the 2016 National Budget.

And there are expectations that this figure will double or even triple when assessment is completed at the end of the 30-day State of Natural Disaster, which has been extended until April 19.

“The pleasing fact is a lot of the tourism plants were not impacted at all,” Reserve Bank of Fiji Governor Barry Whiteside told Business Melanesia two weeks after TC Winston – described as the biggest and strongest tropical cyclones ever to hit the Southern Hemisphere – made landfall in Fiji.

“So the only tourism plant that has been impacted would be Taveuni, Savusavu and a little bit in the Yasawas. But we have been advised that a lot of hotels in the Mamanucas and the Yasawas will be up and running within the next two weeks or so.

“Hotels in most of Viti Levu are operational so the important thing is to get the visitors to come in now. Getting our tourism going will help repair our growth. Our manufacturing sector is still there as most of our towns and cities were not severely damaged.

“The only issue would be electricity supply. If electricity supply is available, then they would be up and running. Those are some of the positives coming out of this. The negatives would be the agricultural sector, sugar especially and of course housing.

Sugar industry impact

“So sugar cane and sugar production are definitely impacted [on] and the severity of that will affect how far we downgrade growth and indeed how much our foreign exchange reserves will be impacted, as sugar is one of our main export commodities. But tourism will hopefully bolster our foreign exchange plus remittances and aid flows that will be coming in. So these are some positives,” Whiteside said.

In a span of less than 24 hours, Category 5 TC Winston had brought about widespread destruction to crops, livestock, infrastructure, homes, buildings and had taken more than 40 lives.

Its impact was not unlike Category 5 TC Pam, which hit Vanuatu in March last year and left behind a damage bill of over 45billion vatu (US$412m) according to an assessment last year by the Asian Development Bank.

In Fiji, the economy is also braced for inflation spikes given the widespread damage to agriculture, which Fiji’s DISMAC had valued at around F$208 million when this edition went to press.

“Normally, imported inflation is very sluggish and stagnant at the moment because oil prices are very low so all food commodity prices weren’t moving too much so not too much impact on that side,” said Whiteside.

“It’s domestic production, domestic supply that will be the issue. So the quicker our farmers get back on their feet and start producing, the quicker the prices will come back down. Hopefully they will get the support needed and be able to put that food supply back into the market within 3 or 6 months at the latest.

“So impact on prices at the moment – expect increases over the next few months in inflation. In January it was 0.2 percent so we’re going to see an increase in that number over the next few months.”

Central bank statement

By press time, the central bank had released a special statement on TC Winston projecting a quick recovery for Fiji based on “firm macroeconomic fundamentals”.

“Added to this is the fact that our core tourism, industrial and large commercial centres remained relatively unscathed by TC Winston. As such, while growth this year is projected to be lower than earlier forecast, it will remain positive, with major added impetus from reconstruction and rehabilitation activity,” the RBF statement said.

“The tourism industry, which has recorded positive arrivals growth in both January and February this year, is expected to pick up pace in the upcoming peak season period. The tourism industry has activated TAG (Tourism Action Group) with the goal to “reassure” our key tourism markets that the major tourism regions are fully operational and open for business. Special air fares and hotel packages were launched last week in the major markets to stimulate arrivals.

“The special response of Fijians abroad as well as our international friends and family will likely boost remittance inflows significantly this year. Initial forecasts suggest that these flows will easily surpass the record $492 million received in 2015. Overall, this year’s economic outlook remains positive although risks associated with a slowing global economy and further natural catastrophes, remain,” the RBF statement said.

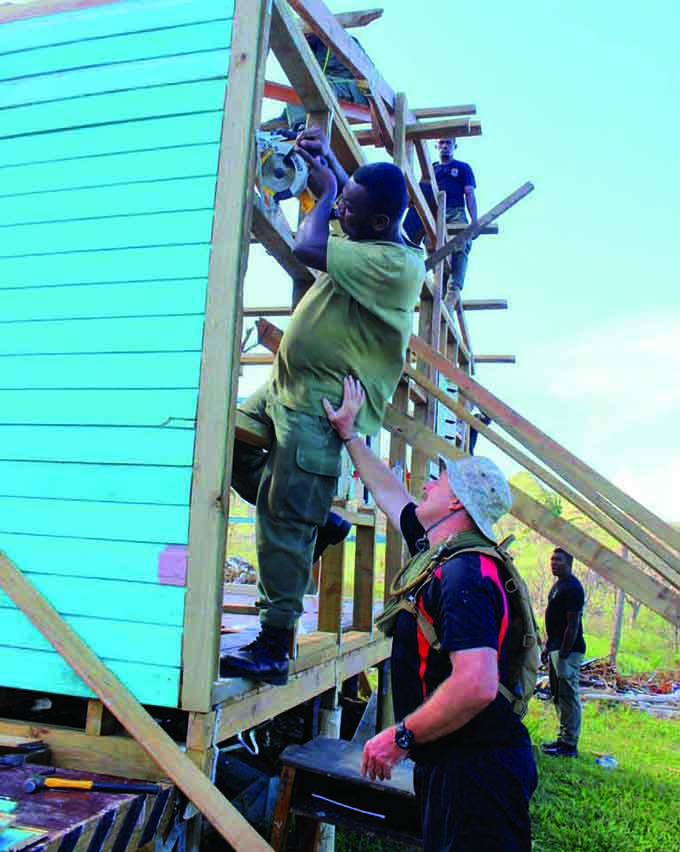

There was also quick reaction to the widespread destruction of homes and dwellings in affected areas with the Fiji National Provident Fund (FNPF) offering its more than 300,000 members withdrawal assistance of up to F$5000 on special grounds and the commercial banks offering low interest rates loans with the assistance of RBF.

“Normally after a disaster, we put in place a facility to make funds available to the commercial banks. It is called the Disaster Rehabilitation Facility, where we provide funds to the commercial banks, if they need it, on a lend-to basis to businesses at a maximum of $500,000 at an interest rate of 5 percent.

“And we also now have just put in place, together with the banks, a facility for small home owners, so those home owners who had their houses damaged and they want a small loan, can front up to a commercial bank for a maximum of $5,000 unsecured loan at an interest rate of 4.5 percent, for a maximum term of 5 years.

‘Roof over heads’

“That won’t make them have a whole house but it will help them repair and put a roof over their heads. And if they add that together with what they can get from FNPF if they’re an FNPF member, they can get up to $10,000 and I think that goes a long way in helping them at least make repairs to their homes,” Whiteside said.

At press time, DISMAC had announced that more than 9000 dwelling were completely destroyed, more than 16,000 damaged and an additional 28,900 as somewhere between completely destroyed and damaged Fiji-wide.

However, later government reports issued at the time of the first state of disaster period elapsing on March 21, said an estimated 32,000 homes were left damaged or destroyed and 350,000 people have been affected by the cyclone.

Dionisia Tabureguci is a journalist with Business Melanesia.This article was first published in Business Melanesia and has been republished by Asia Pacific Report with permission.

[…] is already struggling to cope with the aftermath from the recent tropical cyclone Winston, other storms and the impact of climate change, but suicide among youth is also becoming a major […]

Comments are closed.