By Elena Vucukula in Suva

The main problem in for Fiji retirement is that there is no law to protect the Fiji National Provident Fund, claims a leading trade unionist.

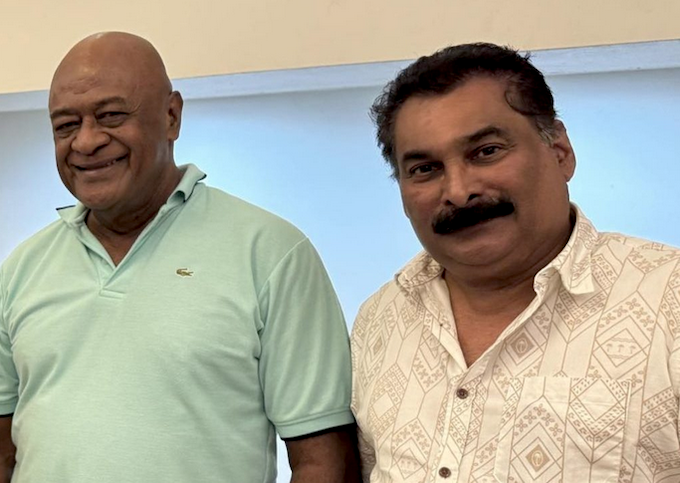

Fiji Trades Union Congress national executive board member and National Union of Hospitality Catering and Tourism Industries Employees general secretary Daniel Urai has told the FNPF 2011 Act review committee in Lautoka that a law needed to be put in place to ensure that the FNPF and its members are protected.

“Whenever something happens, a new government comes in — they will tell FNPF to remove all their investments abroad,” Urai said at the hearing on Friday.

“And that has an effect on the FNPF investment. So, I hope you will find a way to put in a law that no one just comes and directs FNPF to remove all its investments, and that has happened in the past.

“And I hope you can look at ways to ensure that it does not happen.

“Because every time that happens, FNPF loses, and the returns are not what is expected.”

Fiji Trades Union Congress national secretary and FNPF 2011 Act review committee member Felix Anthony claimed the government had interfered with FNPF’s overseas investments in 2007.

Withdrew investments abroad

“Soon after the coup, the government, actually through the Reserve Bank of Fiji (RBF), suggested that FNPF withdraw all its investments abroad,” Anthony said.

“Just so that they keep the Fijian dollar afloat, and that actually affected FNPF income and had some financial ratification on the FNPF bottom line.

“There was some consideration given whether the RBF itself should compensate FNPF for that directive, and nothing eventuated, of course, because the government had a stronghold at that time.”

The Fiji National Provident Fund is conducting a comprehensive review of the FNPF Act 2011 to ensure the law is modern, effective, and continues to meet the retirement needs of Fijians.

The public consultation continued at the Labasa Civic Centre today and will be in Suva tomorrow.

Republished from The Fiji Times with permission.