By Dale Luma and Pearson Kolo in Port Moresby

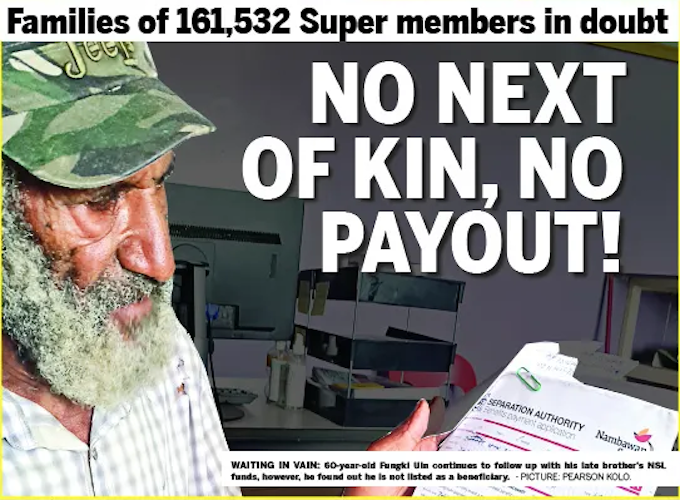

Sixty-year-old Funki Uin continues his struggle in vain in Papua New Guinea as he tries to follow up over his late brother, Jhuke Uin’s, savings parked in a major national retirement fund since he died in 2019.

He has been repeatedly visiting the branch of Nambawan Super Limited (NSL) and the Public Curator’s office for the last two years since brother did not name any next of kin to inherit his life savings when he died.

The worrying fact in this story is that Funki’s plight could be experienced by the families of more than 161,500 other members who do not have a single listed beneficiary for their superannuation savings at both major funds of Nambawan Super (65,000 members) and Nasfund (96,532).

The PNG Post-Courier followed up with the Mt Hagen Public Curators office which responded stating that the superfunds must make the process easy for relatives of their members to have access to their savings.

This is not easy due to the current legal regime governing both the funds and the release of such unclaimed money in the country.

Continuous attempts to get comments from the Public Curator in Port Moresby were unsuccessful.

Uin claims he has followed proper procedures to apply for he funds of his late brother, who was a career public servant with the Southern Highlands provincial government, with no favourable response.

Governed by law

Both Nasfund and NSL stated in their responses to the Post-Courier that they were governed under the Superannuation Act 2022.

Nasfund chief executive officer Rajeev Sharma said: “Our policies and procedures are derived from the Superannuation Act which governs all superfunds (trustees), fund administrators, investment managers and stakeholders.

“As a trustee, our requirements and processes are aligned to both the Superannuation Act and the Prudential Standards to safeguard the entitlements of all members and their beneficiaries.

“As standard procedure, registered beneficiary(s) of the deceased member whose information were provided by the member whilst being an active contributor will have access to information and service.

“A beneficiary of a deceased member must ensure to provide key requirements such as the Medical Certificate of Death, Warrant to Bury, and a confirmation of employment from the most recent employer of the deceased member as verification.

“Beneficiaries are also required to provide identification (ie. valid ID or verification documents) to prove their validity.”

NSL chief executive officer Paul Sayer said: “One of the major challenges we face is that many of our members have not provided a list of their nominated beneficiaries.

Outdated information

“Or if they have, it is outdated, incomplete or has family members left out which often leads to a longer withdrawal process for beneficiaries.

“When a member without any listed beneficiaries passes away, the fund is tasked with identifying the correct people to whom the late member’s entitlements should go.

“The withdrawal process in these instances is extended to include additional verification requirements for each individual that presents themselves.

“They must provide proof of identification and proof of relation to the late member.

“The unlisted beneficiaries are also required to provide additional documents for this verification process which are then reviewed and processed by NSL before releasing the entitlements.”

Both Nasfund and NSL have encouraged their members to update their details with their respective funds.

Dale Luma and Pearson Kolo are PNG Post-Courier journalists. Republished with permission.